Here's What You Need to Know About the 5 Most Common Types of Mortgages

As a realtor, I’m often asked about the state of mortgage rates and when they might dip, making home ownership more accessible. While I can’t predict the future, I can help you understand the basics of the five most common types of mortgages. Understanding these can help you make an informed decision when rates do start to decline.

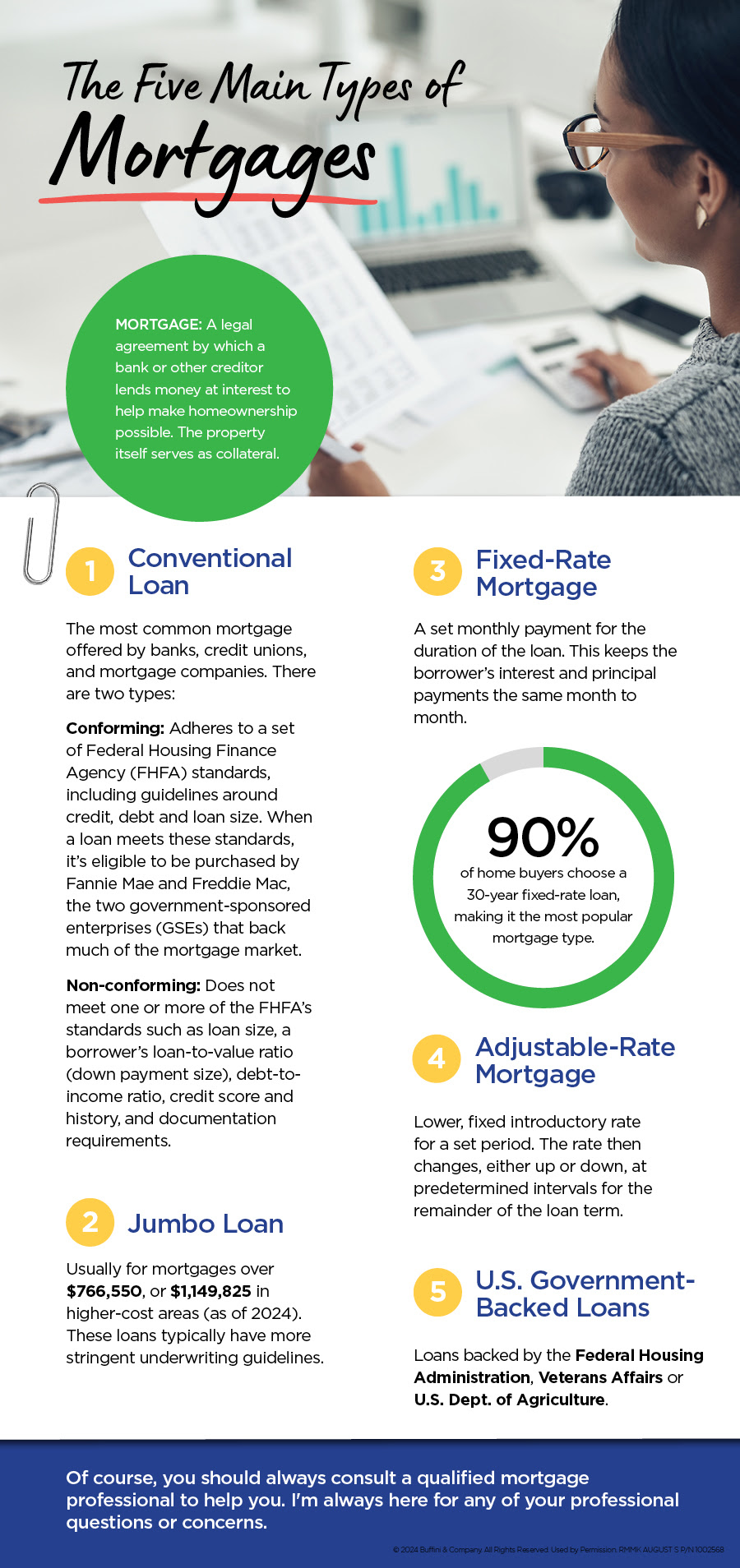

First, the Definition of a Mortgage:

A mortgage is a legal agreement by which a bank or other creditor lends money at interest to make homeownership possible. The property itself serves as collateral.

1. Fixed-Rate Mortgage: Stability Over the Long Haul

A fixed-rate mortgage is the go-to choice for many buyers, and for good reason. The interest rate remains the same throughout the loan’s term, providing consistency in your monthly payments. Whether rates are high or low when you lock in, your rate won’t change — giving you peace of mind in an unpredictable market.

Why Choose It: If you plan to stay in your home for many years, a fixed-rate mortgage offers predictability and security. Remember, though, if rates drop significantly, you might miss out unless you refinance.

2. Adjustable-Rate Mortgage (ARM): Flexibility with a Risky Twist

An ARM starts with a lower interest rate that adjusts over time, typically after 5, 7, or 10 years. This can be tempting if rates are high when you buy, as you’ll start off with lower payments. However, buyer beware — your rate could increase substantially after the initial period, leading to higher monthly payments.

Why Choose It: If you’re planning to move or refinance before the adjustment period, an ARM could save you money. Just make sure you’re comfortable with the potential risks.

3. FHA Loan: A Lifeline for First-Time Homebuyers

FHA loans are government-backed and designed to help first-time buyers or those with less-than-perfect credit. With lower down payment requirements and more flexible lending criteria, FHA loans open the door to homeownership for many who might otherwise struggle to get a mortgage.

Why Choose It: If you’re a first-time buyer or need a bit more financial flexibility, an FHA loan could be your ticket into the market. Just be mindful of the extra insurance costs that come with this type of loan.

4. VA Loan: A Well-Deserved Benefit for Veterans

VA loans are available to eligible veterans, active-duty service members, and their families. These loans offer competitive interest rates, no down payment, and no private mortgage insurance (PMI), making homeownership more affordable for those who have served our country.

Why Choose It: If you qualify for a VA loan, it’s one of the best deals out there. It’s a great way to leverage the benefits you’ve earned through your service.

5. Jumbo Loan: Financing Your Dream Home

For those looking to purchase a high-value property, a jumbo loan might be the best option. These loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac, allowing you to borrow more for a luxury home. However, they typically come with stricter credit requirements and higher interest rates.

Why Choose It: If you’re buying in a high-cost area or seeking a home that requires more financing than a traditional loan allows, a jumbo loan can provide the necessary funds.

Final Thoughts: Navigating the Mortgage Maze

Understanding the types of mortgages available is crucial, especially when mortgage rates are fluctuating. Whether you’re buying your first home or your forever home, choosing the right mortgage can save you a lot of stress and money in the long run.

While the market can be unpredictable, what remains constant is the importance of making informed decisions. I’m here to help you navigate the complexities of the real estate market and connect you with qualified mortgage professionals who can guide you toward the best choice for your situation.

If you or someone you know is thinking about buying or selling, don’t hesitate to reach out. I’m here to help with all your real estate needs.

Source: Matt Weaver

If you have any questions, want to know what the current value of your home is, would like to book an appointment with me or are looking for some free real estate related educational reports; make sure to Check Out My Link tree

Search for your next dream home or find out the value of your current home on my website www.Realvolutionhomes.com

Dan McDevitt

Cummings & Company Realtors

Team Leader Realvolution Homes Group