Homebuyer Alert: Mortgage Payments Drop, Affordability on the Rise!

Mortgage payments are dropping, and affordability is on the rise!

Hey there, homebuyers and real estate enthusiasts! Big news this month – mortgage application payments have decreased to $2,167 in June, marking a 2.4% decline from $2,219 in May, according to the Mortgage Bankers Association. This is a strong signal that homebuyer affordability conditions are improving. L et’s dive into the specifics and explore why this trend is great news for anyone looking to buy a home in today's market.

Improving Affordability

The median new mortgage payment of $2,167 in June is a significant drop from May's $2,219, reflecting a 2.4% decline. According to the Purchase Applications Payment Index by the Mortgage Bankers Association, this decrease indicates improved borrower affordability. When loan application amounts and mortgage rates decrease, or homebuyer earnings grow, affordability improves. It's a clear sign that now might be the time to start house hunting or consider refinancing.

Affordability is key. With the median new mortgage payment down, more buyers are finding it easier to enter the market. This decline means your dream home might be more accessible than you think. Remember, a drop in mortgage rates increases your purchasing power, making it easier to find a home that fits your budget.

Rising Inventory Levels

Housing inventory is increasing, with total units at the end of June up by 3.1% from May and 23.4% from a year ago, according to the National Association of Realtors. This rise in inventory means more options for buyers and less competition, making it an opportune time to buy.

More choices, less stress. With a 4.1-month supply of unsold inventory, buyers are less likely to face bidding wars. More listings mean you can be choosier and find a home that truly meets your needs. Don’t rush – take advantage of the growing inventory to find the perfect property.

Sellers Making Moves

To attract buyers, about one in five homes for sale in June had a price cut, the highest level for any June on record, according to Redfin. Additionally, 31% of home builders cut prices to increase home sales. This trend indicates that sellers are willing to negotiate, which could be beneficial for buyers looking to get a good deal.

Sellers are motivated. With price cuts and incentives from builders, buyers have the upper hand. It's a buyer's market in many regions, particularly in the South where competition is easing fastest. Keep an eye out for these opportunities and don’t be afraid to negotiate to get the best deal possible.

Expert Opinions on Market Trends

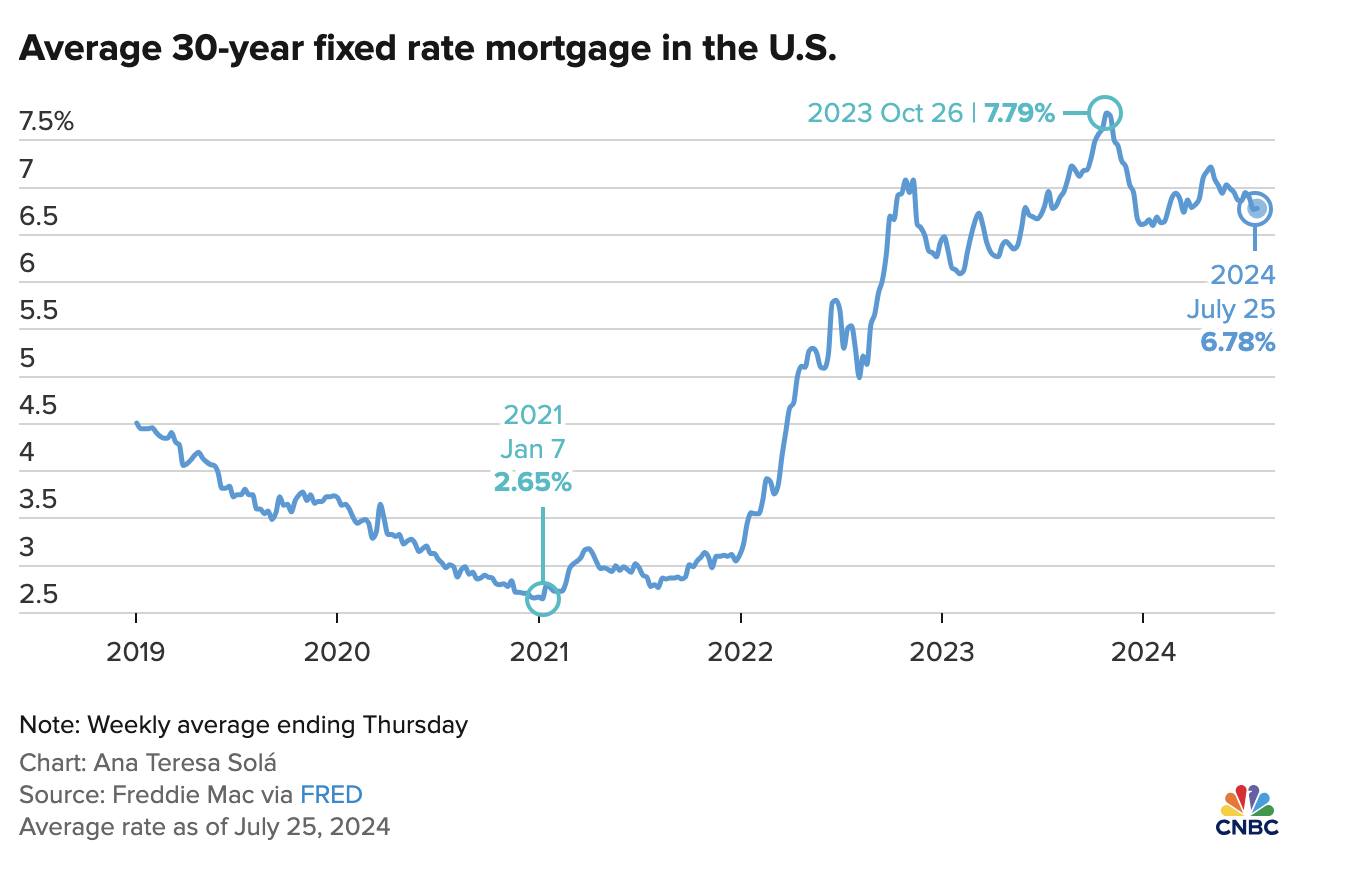

Experts like Edward Seiler from the Mortgage Bankers Association and Lawrence Yun from the National Association of Realtors highlight that housing affordability is improving. While the typical monthly mortgage payment has doubled from pre-COVID years, the recent trend shows positive movement towards affordability.

Trust the experts. According to Seiler, declining mortgage rates are increasing purchasing power, enticing more buyers back into the market. Yun also notes that the market is tilting more towards buyers, with affordability improving modestly but steadily. It's a good time to be in the market, whether you're buying your first home or looking to upgrade.

Strategic Buying Tips

While the market shows positive signs, it's crucial to stay within your budget. Just because mortgage rates have declined doesn't mean you should overextend yourself. Focus on finding a home that fits your financial plan to ensure long-term stability and peace of mind.

Budget wisely. S tick to your budget and avoid the temptation to overspend. A decrease in mortgage rates is beneficial, but it's important to remain financially prudent. This strategy will help you avoid future financial stress and ensure that your home remains a place of comfort and security.

Conclusion

The housing market is showing promising signs for homebuyers, with declining mortgage payments, rising inventory levels, and motivated sellers creating favorable conditions. As always, stay within your budget and take advantage of the current trends to find the perfect home. If you or anyone you know is looking to buy or sell a home, I’m here to help navigate these exciting times in real estate. Feel free to reach out for personalized assistance and expert advice. Let's make your real estate dreams come true!

There you have it! By staying informed and strategic, you can make the most of the current housing market trends. Remember, I'm just a call or email away to assist you with all your real estate needs. Happy house hunting!

Source: CNBC

If you have any questions, want to know what the current value of your home is, would like to book an appointment with me or are looking for some free real estate related educational reports; make sure to Check Out My Link tree

Search for your next dream home or find out the value of your current home on my website www.Realvolutionhomes.com

Dan McDevitt

Cummings & Company Realtors

Team Leader Realvolution Homes Group